Boston Investor’s Meetup

11/07/2016 Royalty and Streaming Model

- https://s1.q4cdn.com/474160313/files/docs_presentations/2016/nov/SILV_AssetHandbook_FINAL_Web_Nov2016.pdf

- https://www.franco-nevada.com/about-us/our-business-model/default.aspx

10/25/2016 Speculative Investing– Fundamentals, Mining and Bullion

A Good Discussion on Royalty and Streaming Companies

https://stansberryresearch.com/investor-education/royalty-companies-safe-returns/

10/11/2016 Time Again for Emerging Markets?

FT Podcast

Here’s an interesting discussion ft FT…. https://podcast.ft.com/2016/09/30/em-brace-the-opportunity/

The Case For Emerging Markets

Emerging markets have disappointed investors in recent years. Stocks have been held back by a mix of weak commodity prices, sluggish export growth, and political disruptions. The result has been a negative return of 11 percent for the MSCI Emerging Markets equity index since mid-2011, lagging a 49 percent upswing in developed markets.

But recently, this trend has reversed. Emerging-market equities have rallied 12 percent this year, outpacing a 4-percent gain for rich nation stocks. Can this last? We believe emerging markets will outpace more defensive developed markets, like Switzerland, and have recently increased our emerging market equity position to overweight in global portfolios. Five favorable factors support this shift:

Steadier Chinese growth. The fortunes of China’s economy are key to the overall emerging-market performance. With an $11 trillion GDP, China is roughly equal in size to the next 10 largest emerging markets combined. While China’s growth trajectory has slowed over the past year, the deceleration has not been abrupt. The 6.7 percent GDP expansion in the second quarter provided additional evidence that government stimulus is stabilizing activity. And rising consumer spending is partly offsetting weakness in the “old economy” industrial sector.

Commodity goldilocks. Raw-material prices are neither too hot, nor too cold. A 20-percent rise in the Bloomberg Commodity Spot index since the January lows has removed a headwind to economic growth and profits in commodity-exporting emerging markets, especially in Latin America. But prices have not climbed so high as to impair the outlook for Asian commodity importers.

Growth gap returning. Last year, emerging-market economies grew just three percentage points faster than developed nations, down from six percentage points in 2009. This growth advantage is likely to expand again in the coming years, particularly as the economies of Brazil and Russia stabilize after deep recessions. Purchasing managers’ indices have improved, with Asian and emerging European gauges back above the 50 level that separates expansion from contraction. Greater political stability could also help. The climate has improved recently in Brazil, with the appointment of a more market-friendly president. Tensions between Russia and the West have also eased.

Profit growth in sight. Earnings per share, which have fallen by around one-third since early 2012, have started to stabilize. That has helped drive the recent emerging-market stock rally. While valuations are now close to the average for the past decade — the trailing 12-month price-earnings ratio of the MSCI Emerging Markets index stands at 13 times — there is room for further price appreciation if profits improve as we expect.

A dovish Fed. The U.S. Federal Reserve is likely to keep rates lower for longer due to the uncertainty created by the UK referendum vote. A more dovish Fed stance than at the turn of the year has boosted emerging market currencies, up 3 percent against the U.S. dollar since then. Stronger emerging-market currencies contribute to lower inflation rates, reducing the need for growth-suppressing interest rate rises.

There are risks to monitor. A lasting rally will require the stabilization of earnings to turn into a full rebound. And the failed coup in Turkey is a reminder that political risk can stoke market volatility. But on balance, we believe the outlook for emerging market stocks is bright.

Commentary by Mark Haefele, global chief investment officer at UBS Wealth Management, overseeing the investment strategy for $2 trillion in invested assets. Follow him on LinkedIn at www.linkedin.com/in/markhaefele.

The Case Against Emerging Markets [VIDEO]

https://www.cnbc.com/2016/08/04/emerging-markets-crushing-sp-but-strategists-say-stay-away.html

After a rocky stock, 2016 has turned into a rather nice year for U.S. stocks. But the emerging markets are doing even better.

The popular emerging markets-tracking ETF (EEM) has risen more than 12 percent this year, performing twice as well as the S&P 500. But Eddy Elfenbein, editor of the Crossing Wall Street blog, says it’s a good time to “take some profits off the table.”

He’s still concerned about the Federal Reserve potentially raising rates and also slowing growth in China. “I’m also very concerned about oil, which has been falling in recent days, and many of the emerging markets are heavily dependent on commodities,” he said.

A major commodities bounce, a mitigation of China concerns and reduced expectations around the Fed’s rate-hiking schedule have helped the EEM bounce off of its lows. But the gains associated with a moderating dollar aren’t set to continue, according to Elfenbein.

“Emerging markets are very much driven by the dollar, when the dollar is strong that’s like a magnet, it just pulls all the money,” Elfenbein said Wednesday on CNBC’s “Power Lunch.” “Remember, we were going to have those four rate increases, that was going to help the dollar, that never materialized and that was a green light for people to go back into the emerging markets.”

The EEM’s exposure is about 25 percent to China, 15 percent to South Korea, 12 percent to Taiwan and 8 percent to India.

Interestingly, it’s some of the smaller emerging markets that have done best this year. A change in political leadership in Brazil and Argentina sent their markets up more than 30 percent. In Russia, stocks have gone higher as a result of oil coming off its lows. In Asia, the best-performing market is Indonesia where shares are up 17 percent. Indonesian President Joko Widodo is seen as a pro-business leader who will spur economic reform, boosting investor confidence.

In the options market, investors as a whole appear to be placing bullish bet on emerging markets.

Susquehanna’s head of derivative strategy, Stacey Gilbert, who was also appearing on “Power Lunch,” said that options sentiment around the EEM is such that investors are “protecting a little bit [but] willing to get in [if the EEM is] more down 10 percent. Overall, I think people like emerging markets.”

9/30/2016 Credit Opportunities Discussion

https://albertklu.com/wp-content/uploads/meetup/201609SCO.pdf

10/20/15 Asset-Backed Securities

VIDEOCAST | THE POWER AND MARKET REPORT

REIT Discussion

CT Trust

Blackstone Mortgage Trust

Origination

- https://www.blackstonemortgagetrust.com/press-releases/2012/12/19/capital-trust-closes-on-sale-of-investment-management-platform-to-blackstone

- https://www.bloomberg.com/news/articles/2013-10-29/blackstone-adds-to-biggest-year-for-reit-ipos-since-2004

Company Presentation

- https://www.blackstonemortgagetrust.com/docs/default-source/presentations/bxmt-presentation-8-7-15.pdf?sfvrsn=10

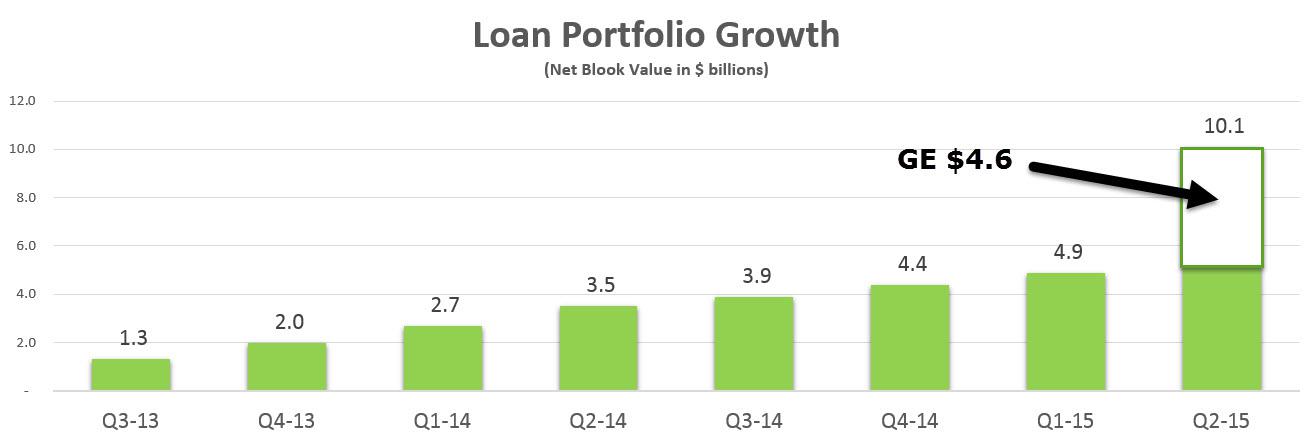

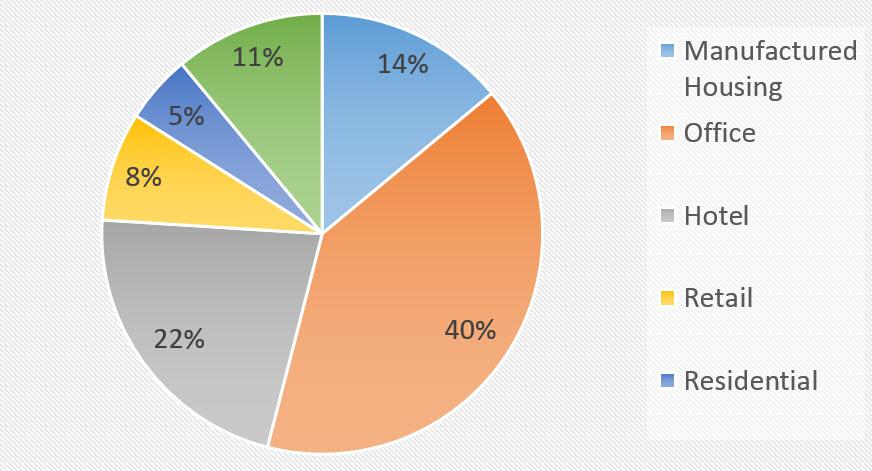

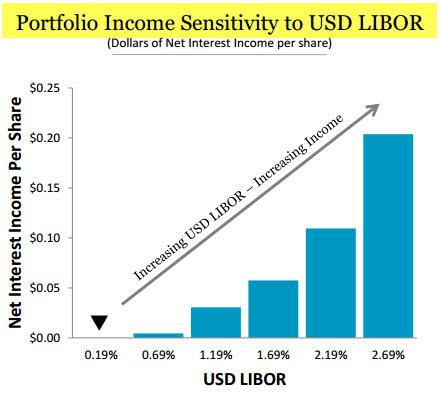

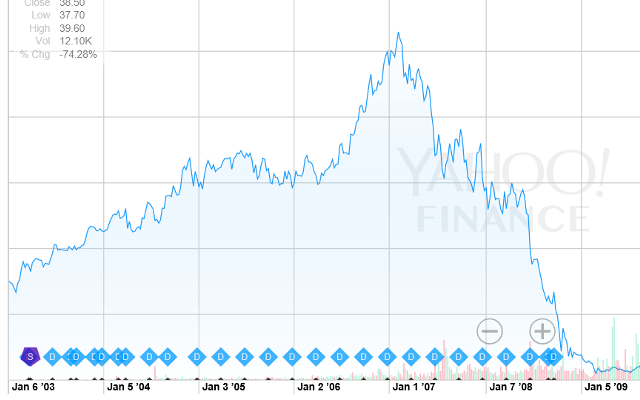

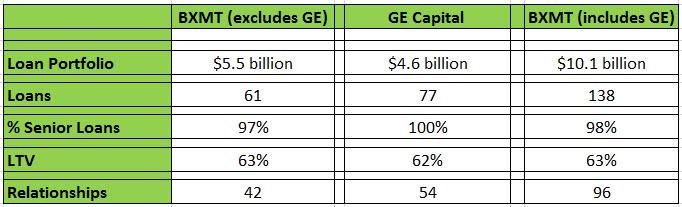

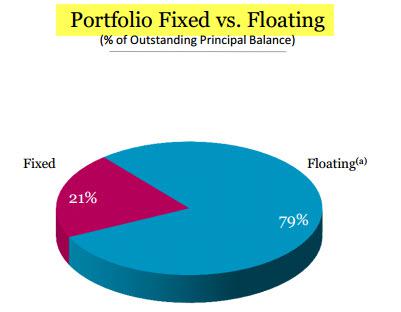

Key Figures

Helpful Links

- https://seekingalpha.com/article/3550476-its-time-to-capitalize-on-blackstone-mortgage-now-yielding-9-percent

- https://seekingalpha.com/article/3512446-dividend-sustainability-analysis-for-blackstone-mortgage-trust-part-1

- https://seekingalpha.com/article/3532616-dividend-sustainability-analysis-for-blackstone-mortgage-trust-part-2

- https://www.investinganswers.com/investment-ideas/income-dividends/george-soros-top-4-retirement-stocks-22038

- https://www.fool.com/investing/dividends-income/2015/06/03/stocks-to-watch-mortgage-reits.aspx

Disclaimer

For informational purposes only. Consult an investment advisor before investing. Investing involves risk